Wealth Services

Weekly Market Update

August 5, 2024

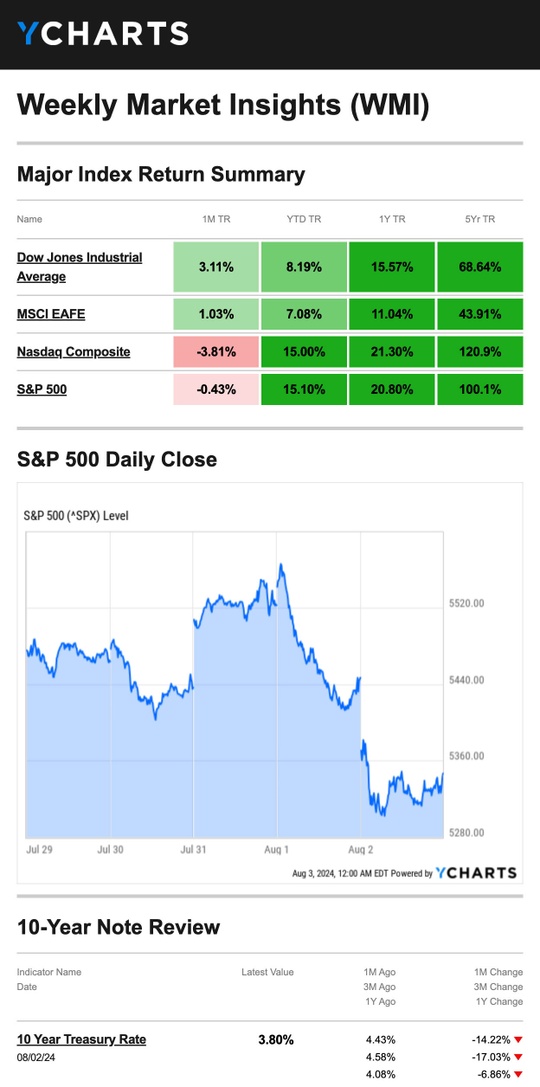

Stocks fell broadly last week as investors looked past upbeat Fed comments and focused on disappointing corporate reports and weaker-than-expected economic data.

The Dow Jones Industrial Average lost 2.20 percent, while the Standard & Poor’s 500 Index fell 2.06 percent. The Nasdaq Composite Index dropped 3.35 percent. By contrast, the MSCI EAFE Index, which tracks developed overseas stock markets, gained 0.19 percent for the week through Thursday’s close.1

Volatile Week of Trading

Stocks were under pressure early in the week as investors appeared to focus on the Fed’s meeting, which ended on Wednesday. It was a big week for Q2 corporate reports, with five of the ten largest names in the S&P 500 (by market capitalization) reporting numbers. But attention was mainly on the Fed’s meeting.2,3

Stocks rallied on Wednesday when Fed Chair Powell indicated a September interest rate cut was “on the table."4

But selling picked up on Thursday as investors' attention quickly shifted to disappointing corporate reports and weak economic data. Friday morning's disappointing June jobs report raised even more concerns about the economy's strength. The Nasdaq ended the week in correction territory, down more than 10 percent from its recent all-time high.5,6

Economic Concerns

Fresh economic data suggested weakening manufacturing, construction, and employment outlooks. On Friday, the Labor Department’s July jobs report showed a sharper-than-expected job growth slowdown and an unemployment uptick to 4.3 percent—the highest rate in 2½ years.

At Wednesday’s Fed press conference, investors welcomed Powell’s unusually candid and upbeat comments. However, as the week progressed, investors started questioning whether the Fed was misreading the economy and moving too slowly in adjusting interest rates.7

This Week: Key Economic Data

Monday: ISM Services Index. Fed Official Mary Daly speaks.

Tuesday: International Trade in Goods and Services. Treasury buyback announcement.

Wednesday: Consumer Credit. EIA Petroleum Status Report.

Thursday: Jobless Claims. Fed Balance Sheet.

Source: Investors Business Daily - Econoday economic calendar; August 2, 2024.

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Amgen Inc. (AMGN), Caterpillar Inc. (CAT), Uber Technologies, Inc. (UBER), Airbnb, Inc. (ABNB)

Wednesday: The Walt Disney Company (DIS)

Thursday: Eli Lilly and Company (LLY), Gilead Sciences, Inc. (GILD)

Source: Zacks, August 2, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Sources

The Wall Street Journal, August 2, 2024

The Wall Street Journal, August 2, 2024

S&P Global, July 31, 2024

The Wall Street Journal, July 31, 2024

The Wall Street Journal, August 1, 2024

CNBC.com, August 2, 2024

The Wall Street Journal, August 2, 2024