Employee Benefits

Legal Alert: IRS Issues Affordability Percentage Adjustment for 2026

July 23, 2025

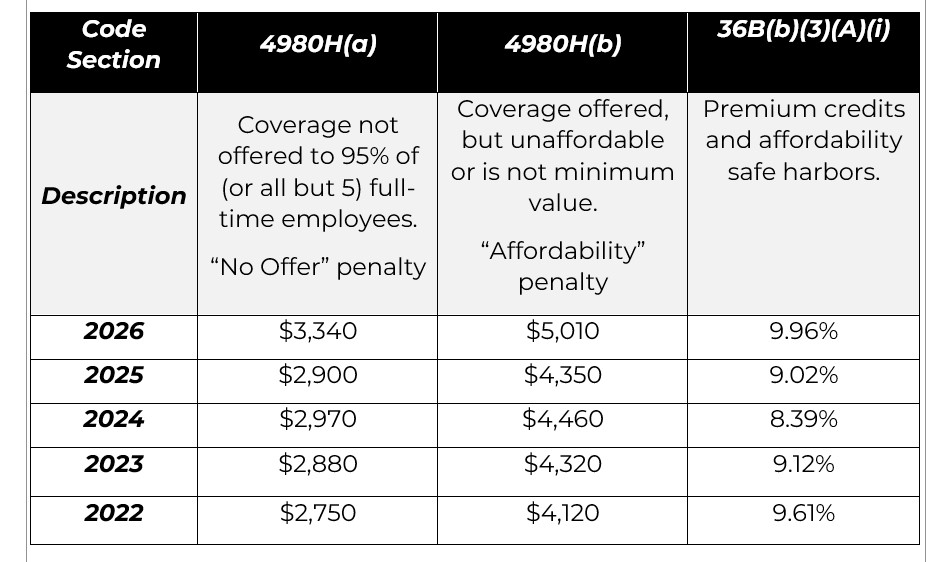

The Internal Revenue Service (IRS) has released Rev. Proc. 2025-25, which contains the inflation adjusted amounts for 2026 used to determine whether employer-sponsored coverage is “affordable” for purposes of the Affordable Care Act’s (ACA) employer shared responsibility provisions and premium tax credit program. As shown in the table below, for plan years beginning in 2026, the affordability percentage for employer mandate purposes is indexed to 9.96%. This is a significant increase from 2025. HHS used a premium growth measure provided for in the 2026 HHS Marketplace Integrity and Affordability Rule when calculating the increase. This measure will be used for the 2026 benefit year and beyond. The IRS has also released Rev. Proc. 2025-26, which contains the indexed amounts used to calculate employer shared responsibility payments (ESRP) for 2026.

Under the ACA, applicable large employers (ALEs) must offer health insurance coverage to full-time employees. If an ALE does not offer coverage (or does not offer affordable coverage), it may be subject to an ESRP. An ALE is an employer that employed 50 or more full-time equivalent employees on average in the prior calendar year. Coverage is considered affordable if the employee’s required contribution for self-only coverage under the employer’s lowest-cost, minimum value plan does not exceed 9.96% of the employee’s household income in 2026 (prior years are also shown above). An ALE may rely on one or more safe harbors in determining if coverage is affordable: W-2, Rate of Pay, and Federal Poverty Level. If the employer’s coverage is not affordable under one of the safe harbors and a full-time employee is approved for a premium tax credit for Marketplace coverage, the employer may be subject to an ESRP.

Since 2019, the individual mandate penalty imposed on individual taxpayers for failure to have qualifying health coverage was reduced to $0 under the Tax Cuts and Jobs Act, effectively repealing the federal individual mandate. A previous lawsuit challenging the constitutionality of the ACA due to this change to the individual mandate penalty was unsuccessful. The employer mandate has not been repealed, and the IRS continues to enforce it through Letter 226J. The IRS is currently enforcing employer shared responsibility payments for tax year 2023 as well as enforcing the reporting requirement itself. The IRS aggressively enforces the ACA reporting requirement, notifying applicable large employers via Letter 5699 if the IRS has not received the employer’s form 1094-C and forms 1095-C.

Federal Poverty Level (FPL) Safe Harbor for 2026

Employers using the FPL safe harbor to ensure their coverage is affordable may set a required employee contribution that does not exceed 9.96% of the mainland single federal poverty line in effect within six months before the start of the plan year, divided by 12. For calendar year 2026 plans, this means that the FPL safe harbor is calculated by taking the 2025 FPL ($15,650) multiplying by 9.96% and dividing by 12 to get a monthly rate of $129.895. While in many cases the IRS permits standard rounding (such as to $129.90), a cautious approach is to set the FPL safe harbor at $129.89 for calendar year 2026 plans.

Action Items for Employers

This change in the affordability threshold for next year affords employers a sizable increase (almost 1%) from 2025 in terms of setting affordability. As such, Applicable Large Employers should do the following in preparation for 2026:

- Familiarize themselves with the updated, increased affordability percentage for plan years beginning in 2026.

- Factor in this increase when setting employee contribution rates for plan years beginning in 2026 to ensure coverage will be affordable. For employers with non-calendar year plans, use the affordability percentage in place at the start of the plan year.

- Be prepared to file forms 1094-C and 1095-C with the IRS electronically in 2026.

Check to ensure prior year forms have been filed and accepted by the IRS. Employers who e-file receive a receipt ID if their filing is “accepted” or “accepted with errors.”

About the Author. This alert was prepared for Alera Group by Barrow Lent LLP, a national law firm with recognized experts on ERISA and the Affordable Care Act. Contact Stacy Barrow or Nicole Quinn-Gato at sbarrow@marbarlaw.com or nquinngato@marbarlaw.com.

The information provided in this alert is not, is not intended to be, and shall not be construed to be, either the provision of legal advice or an offer to provide legal services, nor does it necessarily reflect the opinions of the agency, our lawyers, or our clients. This is not legal advice. No client-lawyer relationship between you and our lawyers is or may be created by your use of this information. Rather, the content is intended as a general overview of the subject matter covered. This agency and Barrow Lent LLP are not obligated to provide updates on the information presented herein. Those reading this alert are encouraged to seek direct counsel on legal questions.

© 2025 Barrow Lent LLP. All Rights Reserved.